Ingrīda Drazdovska, “Delfi Bizness”, 15.10.2024

The real estate market in Jūrmala is viable and relatively active even in the current circumstances, although it has changed. At the same time, some property owners have not “shifted” to the new reality and are hoping for wealthy buyers from neighboring Eastern countries, who will be willing to purchase properties at “old-time” prices.

This is what Ilze Mazurenko, the owner of the real estate company “Latvia Sotheby’s International Realty,” told “Delfi Bizness.”

Despite the relative expense of properties in the resort town, there is not much quality supply that meets the expectations of today’s property seekers. The market is supported by local buyers, and there are quite a few of them.

Bank Requirements and Limited Supply

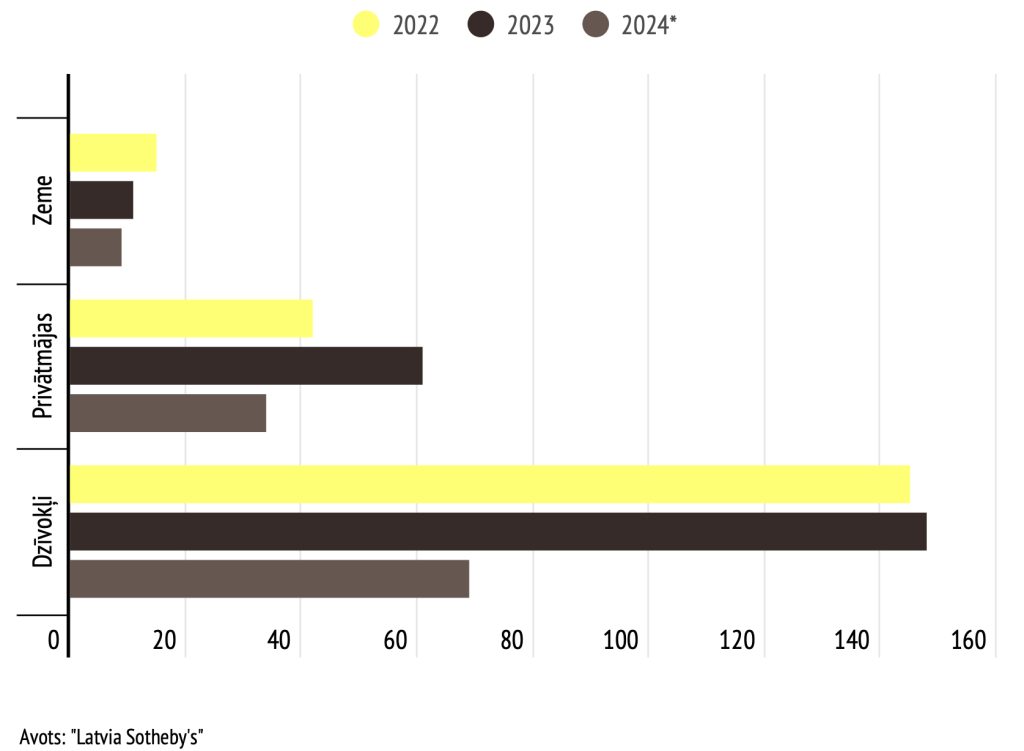

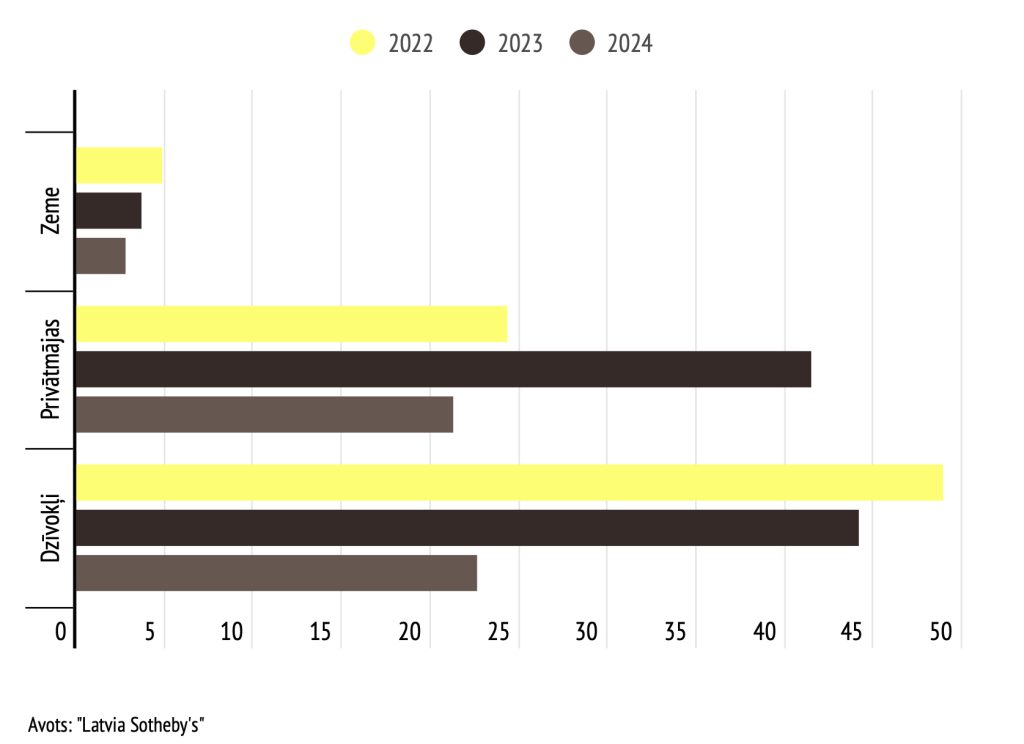

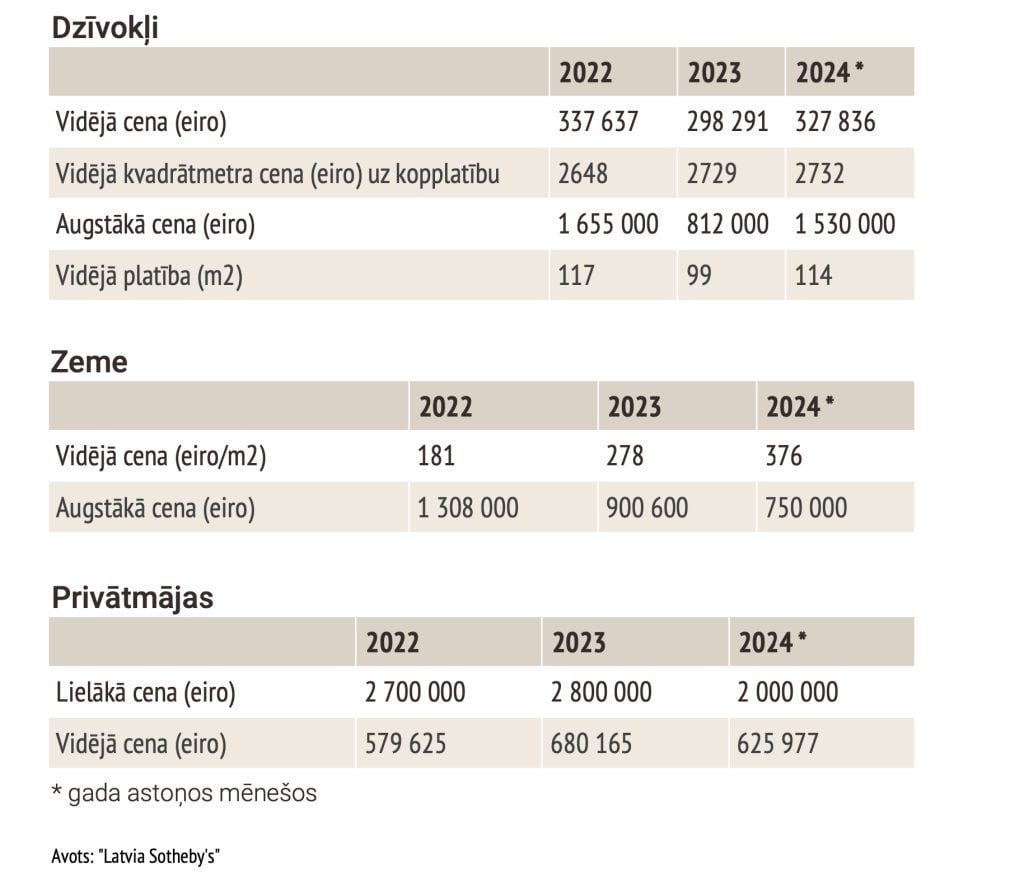

However, the number of private houses purchased in Jūrmala and the total transaction volume (amount) has been significantly lower by September this year compared to last year. The largest transaction in the private house segment this year amounted to two million euros (in the “Bulduru villas” project), while last year it was 2.8 million euros.

Both the number of transactions and the total volume have also decreased in the apartment segment. The most expensive apartment bought this year was for 1.53 million euros. By September, nine land plots have been purchased in Jūrmala, and it is possible that the total number of transactions for the year will match last year’s figure of 11.

Mazurenko suggests that one of the reasons for the decline is the vetting of parties involved in transactions – banks have not eased their requirements, and transactions are especially complicated when non-residents are involved. Moreover, in the premium segment, both buyers and sellers have high demands and expectations. For example, some sellers expect their properties to be valued as they were in the past, regardless of the current market situation.

At the same time, the company’s experience shows that there are relatively few high-quality new projects in the private house sector in Jūrmala that are not overly large. Potential buyers are willing to part with up to two million euros for a quality private house, but there is no adequate supply to meet this demand.

The same applies to the apartment market, where there is a lack of high-quality, modern, and modest-sized apartments with functional layouts and a sufficient number of bedrooms. Additionally, many properties have not been renovated in a long time, are furnished with outdated furniture, and have other peculiarities.

Real estate transactions in Jūrmala

Number of real estate transactions

Total value of real estate transactions

Overpaying

Overall, analyzing the data on apartment purchases reveals an interesting picture. Among the largest transactions in terms of money are both truly high-value properties and those that raise questions about the price-quality ratio – it is possible that the buyer may not be happy with such a purchase later.

“Looking more closely at apartment transaction prices per square meter and knowing the specific buildings where these properties are located, their quality, one can only wonder that a worn-out property that has been in the rental market for a long time costs around or over 4,000 euros per square meter. This means that people are willing to pay more for a product than its actual content offers,” explains “Latvia Sotheby’s International Realty” senior sales consultant Līga Kohtanena. In her opinion, this is a niche where housing developers have opportunities.

Real estate developers are currently very cautious about starting new construction projects, especially in the apartment segment, Mazurenko adds. However, the company has managed to convince some of its clients of the market’s potential. “They have bought land plots and plan to build residential homes in Jūrmala. The challenge will be balancing price levels and people’s purchasing power,” she says.

However, it is still unclear when these projects will materialize. Project preparation and approval in Jūrmala can take a couple of years.

Property prices in Jūrmala

Apartments Are Not Coveted

Currently, the majority of property buyers are local residents. It is the “average” Latvian citizen who ensures the majority of transactions and volumes, emphasizes Kohtanena.

The budget for most local buyers is between 200,000 and 350,000 euros, while there have been nine transactions above 500,000 euros by the end of August this year. People demand quality and a good location, but the supply, as she describes it, is “disappointing.” In recent years, only a few apartment buildings have been built, so most transactions are in the secondary market. Additionally, some of the new apartments have the status of “apartments,” which essentially means buying shares in a co-ownership property, leading to possible future complications when agreeing on anything. Therefore, demand for them is lower, and developers are not eager to pursue such projects.

Interest in Jūrmala properties remains, and there are still transactions with non-residents (holding passports from Malta, Cyprus, Monaco, the United Kingdom, or other countries) who can navigate the complicated and time-consuming process of going through bank scrutiny. Some of these foreign clients get tired of this and give up on buying property in Jūrmala, while others choose alternatives such as investing in Spain, Mazurenko says.

Jūrmala also attracts interest from neighboring Lithuania, partly because prices in the coastal areas there are significantly higher. Many are considering opportunities in Liepāja and its surroundings, while some are specifically interested in Jūrmala. Communication with potential buyers from Lithuania is regular, although there have not been many transactions. Meanwhile, Estonians are not interested in Jūrmala, Kohtanena reveals.

Also, most property sellers in the resort town are local residents, and it is rare for non-residents to offer properties. Speaking about Russian citizens, they sold their properties in Latvia earlier when the war began.

Developer’s Comment

Andrejs Ščerbakovs, head of the Real Estate Sales Department at “Rietumu Bank” and board member of “Apella,” said:

The new residential project market in Jūrmala is currently not very active, as many projects were aimed at a different target audience (large spaces, high maintenance costs), and now the developers need to attract new buyers – which, of course, is possible, but requires additional time and investment.

At the moment, we are implementing the “Sun Sail” project in Majori, which is planned to be completed by the end of 2024. The building will have 26 apartments with eight types of functional layouts, including larger apartments with various-sized roof terraces, apartments with balconies, as well as ground-floor apartments with private entrances and gardens. All apartments will be fully finished; prices start at 180,000 euros.

So far, 30% of all homes have been sold, indicating buyer interest in this project. We do not feel sharp competition, as the project is located in the city center. The residential building will be new, built according to modern energy efficiency standards. The apartments are being sold as separate properties with shares in the land ownership. This is rare in Jūrmala. Moreover, the apartments are not particularly large (mostly 48-65 m²), so they can be purchased by people with both high and average incomes. The target audience is mainly residents of Latvia, as well as other Baltic and European countries.

We plan to develop other residential projects in Jūrmala, which will be conceptually suited mainly to Latvian residents.

Waiting and Not Getting Results

Given the current market situation, it is possible that someone may come across a favorable deal. However, overall, many sellers’ price expectations are detached from reality.

“At the beginning of the summer, we call all the property owners who have expressed a desire to sell, discuss the current market situation, and encourage them to consider offers that will be made. Later in the autumn, a price reduction, which would have worked at the beginning of the summer, no longer does. Now, with the season ending, the price reduction would have to be even more aggressive, or the owner must wait until next year, but none of us knows what it will be like,” Mazurenko explains market nuances.

Kohtanena also knows of cases where sellers refuse potential buyers who offered a market-appropriate price or even slightly above it, thus losing years waiting for what they believe to be the right price. “You definitely need to consider offers, as there are not many buyers in the premium, luxury property segment, and they are very picky,” she advises.

In the Grip of Expectations

Describing demand for properties for business use, the experts note that some transactions have taken place, including the previously mentioned land plot purchases for housing projects.

Project developers have even higher demands than private house owners, Mazurenko notes. They have a clear vision and prepared calculations, which they use to convince people of the project’s advantages and a profitable future business. “However, the reality is often different – they ask for millions for the land, but the developers themselves often do not even have the money to clear the bushes on their property. If there is no money and no ability to build and sell homes at the prices indicated in the tables, they should lower the land price and let others build,” Mazurenko concludes.

She also emphasizes that Jūrmala lacks an international brand hotel with a spa. Mazurenko herself is involved in a project in Dzintari, on Turaidas street 10/12, where such a hotel is planned.

Business development in Jūrmala is also of interest to companies providing other services, including healthcare centers. “There have been attempts to find a place for a rehabilitation facility, for example. If a company finds a property and wants to expand it to suit business needs, they often face various construction restrictions, so they abandon the idea,” Kohtanena says. This is why Jūrmala has a strong residential character, while business activity remains secondary.

At the same time, Jūrmala still has the potential to regain its full resort city status, including with spa hotels and developed medical services, such as rehabilitation centers.

Resource: The property sellers in Jūrmala are stuck in the past and still hoping for a windfall