Summarizing the Latvian premium housing market overview and data from 2024, Latvia Sotheby’s International Realty is pleased to report that this segment of the real estate market in Riga, Jurmala, and the Pieriga region demonstrated selective but stable activity in the apartment, private house, and land segments. Overall, in 2024, the Latvian premium property market showed resilience and gradual growth in specific segments.

Latvia’s Premium Housing Market – 2024 Overview

Latvia Sotheby’s International Realty’s research analyzes the real estate market in Riga, Jurmala, and the Pieriga region, focusing on three property segments – land, apartments, and houses. Transactions in the Pieriga region include those in the municipalities of Ādaži, Ķekava, Mārupe, Olaine, Ropaži, Salaspils, Saulkrasti, and Sigulda.

The study included only those transactions that met specific criteria regarding property type, price, and construction period. Land was considered only for private house development, with a minimum transaction value of €150,000. The apartment segment includes not only apartments but also row houses and semi-detached houses, with a minimum price of €150,000. Houses were assessed based only on the main building area, with a minimum purchase price of €350,000.

To determine average price per square meter (EUR/m²) by region, the average of the price per square meter of each transaction was used, not the total sales volume and total square meters sold.

General Overview by Latvia Sotheby’s International Realty

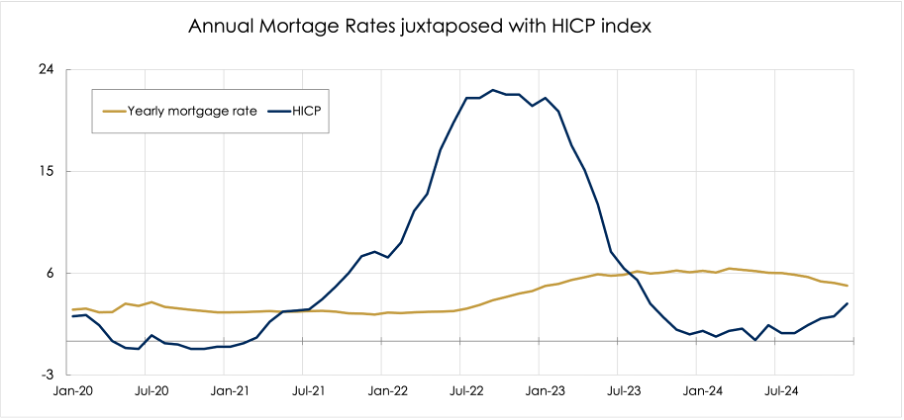

In 2024, inflation significantly decreased from the peak levels of 2022–2023, while mortgage APRs remained stable with a slight decline in the second half of the year (see Figure 1). The real interest rate (nominal interest rate minus inflation rate) reached its highest point in recent years at the beginning of 2024. Inflation increased slightly throughout the year but remained below mortgage APR levels.

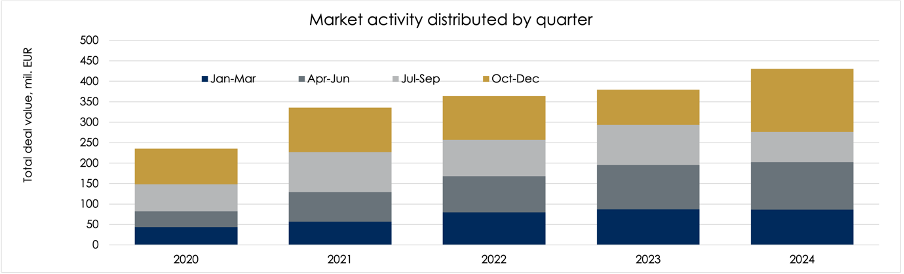

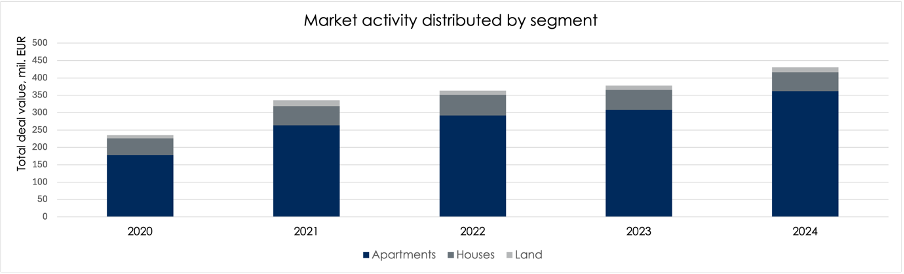

Over the past five years, Latvia’s real estate market has experienced steady growth. Compared to 2023, the market in 2024 grew by more than 12%, reaching approximately €430 million in total sales volume (Illustration 2).

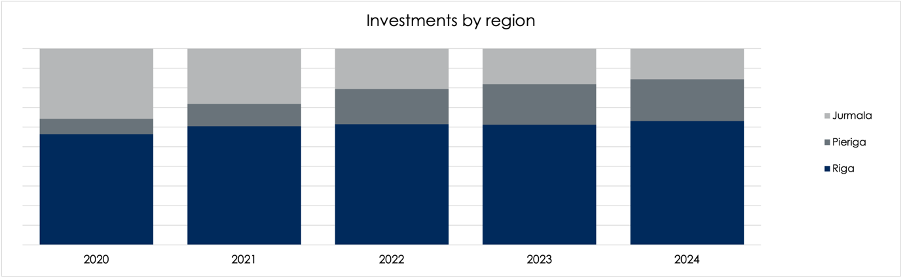

As usual, the largest investment volume was concentrated in the capital city – Riga. Meanwhile, Pieriga and Jurmala maintained a stable but relatively smaller share of the overall market, with Pieriga gradually overtaking Jurmala in terms of total investment volume (Illustration 3). Additionally, transaction activity typically peaked in the fourth quarter of each year (Illustration 4).

Apartments

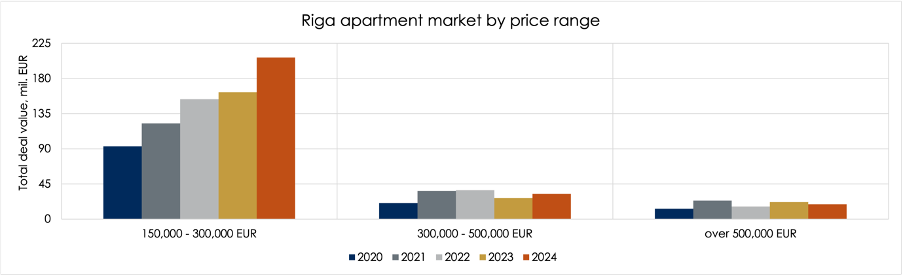

Riga’s premium apartment market continued its gradual growth in 2024, particularly in the lower price segment (EUR 150,000–300,000), where a significant increase was observed in both transaction volume and total turnover, reaching a new five-year high of over EUR 250 million (Figure 5). This indicates a growing demand for properties in the capital. The mid-range (EUR 300,000–500,000) and high-end (over EUR 500,000) segments remained stable throughout the year.

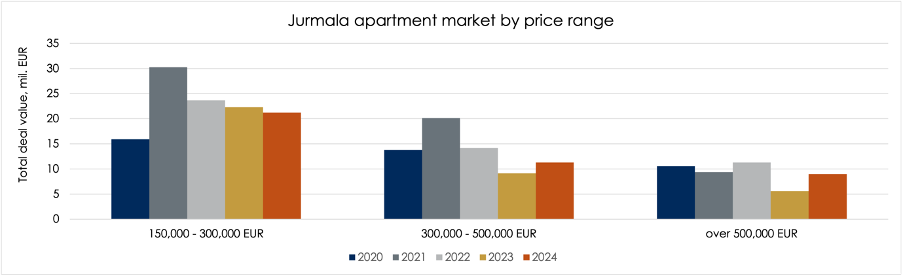

In 2024, Jurmala’s premium apartment market improved slightly compared to 2023 but has not yet recovered to 2021–2022 levels. The EUR 150,000–300,000 segment remained the largest by turnover, but transaction values continued to decline (Figure 6), from EUR 30 million in 2022 to approximately EUR 21 million in 2024. This indicates a retreat from previous buyer activity even in this more affordable segment.

The mid-range segment saw an even sharper decline compared to 2021, reaching only 55% of the previous turnover, although it still outperformed 2023 results. The exclusive segment showed the smallest difference, with a total volume of just under EUR 9 million across 12 transactions—only EUR 1 million less than the 2020–2022 average. It is worth noting that Jurmala transactions are often recorded differently than in reality, leading to a higher potential error in data accuracy.

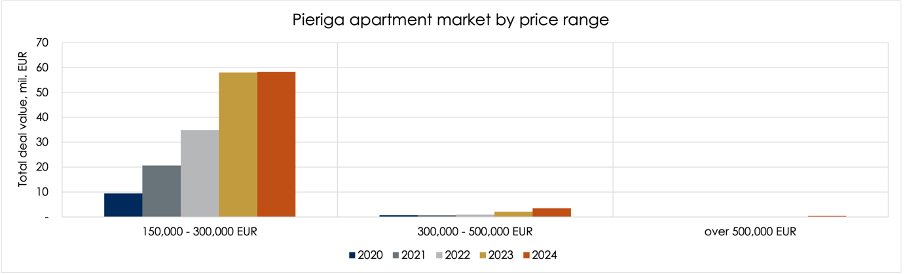

The Pieriga region did not experience significant changes compared to the rapid growth of previous years, increasing by only 3.3% from EUR 60 million to EUR 62 million. The lower segment (EUR 150,000–300,000) is the most dominant in the Pieriga region, making up more than 90% of all apartment transactions (Figure 7).

A large portion of these transactions consists of twin houses or row houses. While the Pieriga region has struggled to attract buyers willing to pay more than EUR 300,000, nevertheless this share increased slightly in 2024.

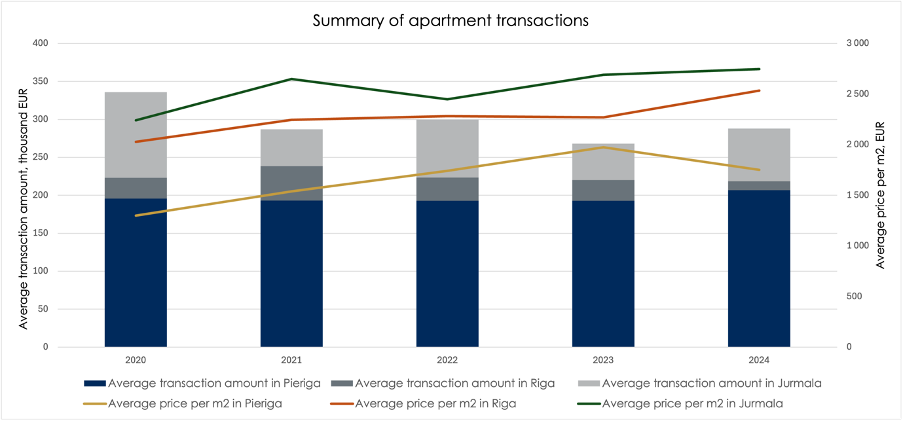

The average transaction amount in the Pieriga region has remained very stable over the past five years, fluctuating between EUR 200,000–210,000. Similarly, in Riga, average transaction amounts have not seen drastic changes—rising slightly in 2021, declining in 2023, and showing a slight increase again in 2024. In contrast, Jurmala’s transaction amounts have been more volatile, peaking in 2020 (approximately EUR 340,000) and subsequently declining before a partial recovery in 2024 (Figure 8).

Looking at the average price per square meter, Jurmala consistently holds the highest value throughout the period, exceeding EUR 2,700/m² in 2024. In Riga, the price per square meter has been gradually increasing, reflecting steady but slow growth. Interestingly, in the Pieriga region—where a gradual price increase had been observed until 2023—the average price per square meter decreased for the first time in 2024.

Private Houses

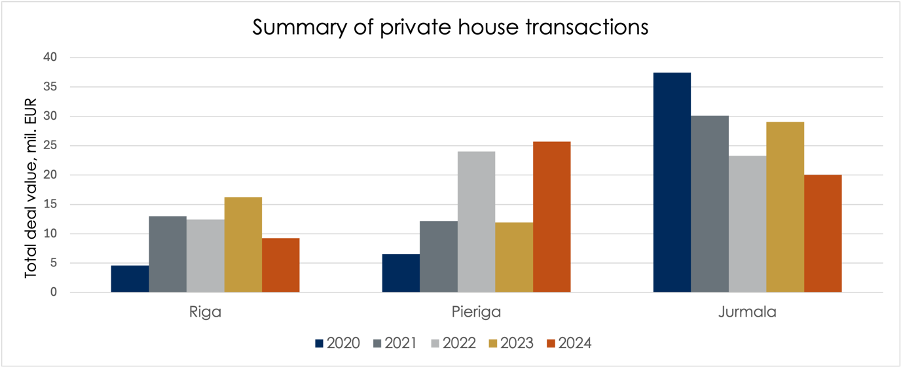

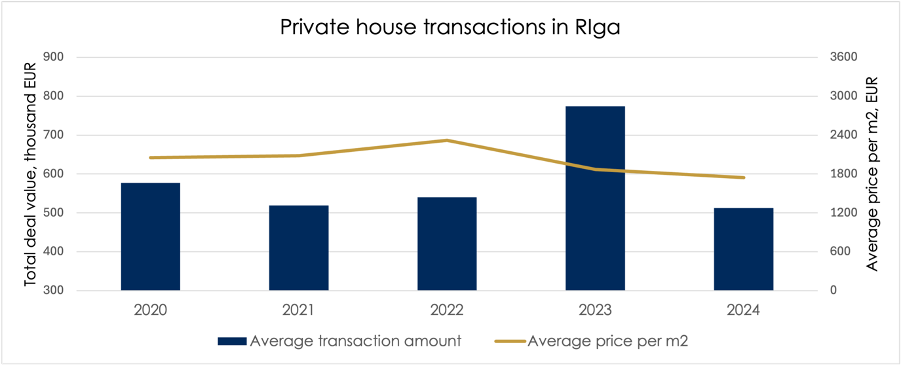

In Riga, the premium private house market saw a decline of over 40% compared to 2023 and 25% compared to 2022 and 2021, marking the worst performance among the three regions (Figure 9). The average transaction price in the premium segment dropped back to previous levels after an exceptionally strong 2023. The price per square meter continued to decline, falling below EUR 1,800/m² (Figure 10).

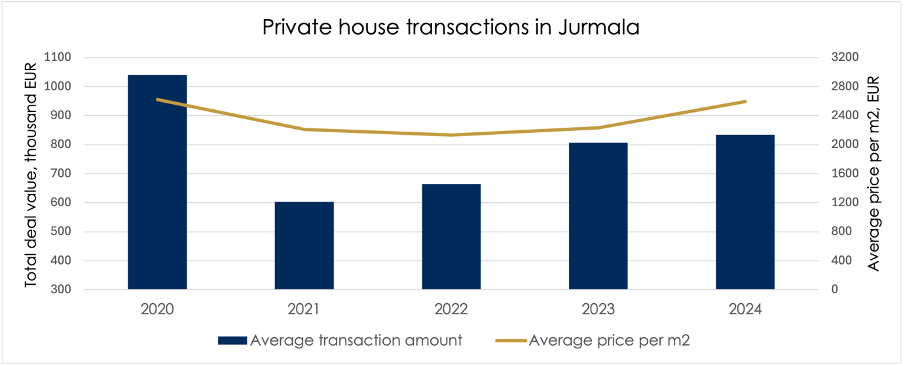

In Jurmala, the private house market continued its negative trend, which began in 2021. Transaction values reached only EUR 20 million, although the average transaction price increased beyond the EUR 800,000 threshold, as did the price per square meter—EUR 2,594/m² (Figure 11).

It is important to note that Jurmala’s house prices per square meter are highly uneven, with some transactions significantly exceeding the average value. This trend is also evident in apartment and land transactions. Notably, Jurmala recorded the highest number of private house transactions exceeding EUR 1 million—nearly 30% of all private house transactions in 2024.

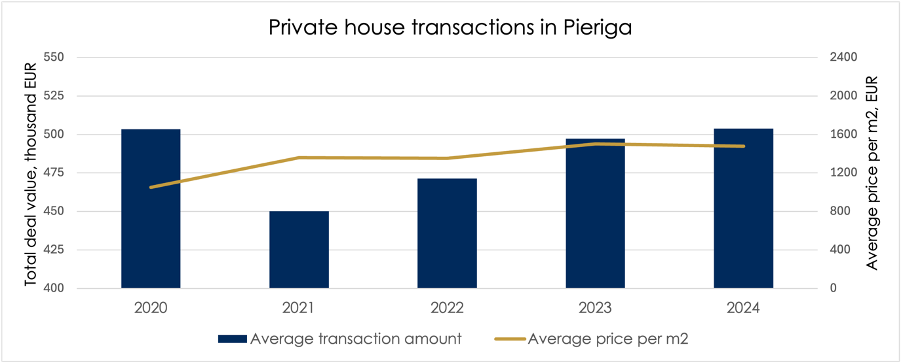

The Pieriga region performed best in 2024, surpassing Jurmala by 25% and Riga by over 150% in total transaction value. The region also exhibited stable trends in both average transaction amounts (over EUR 500,000 in 2024) and price per square meter, exceeding EUR 1,750/m² (Figure 12).

Land

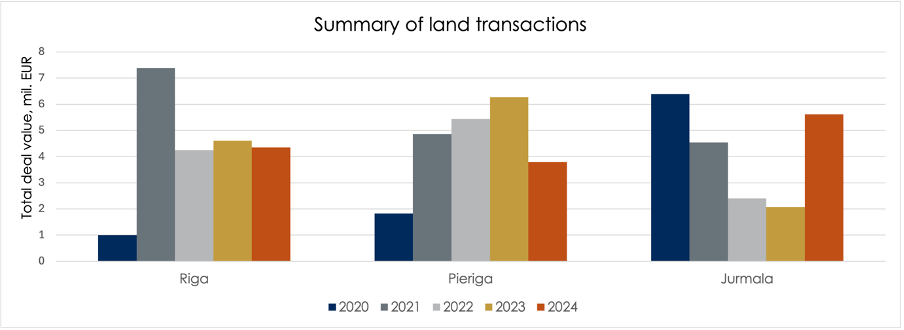

Total land transaction volume across all three regions remained moderate in 2024, exceeding EUR 13.5 million. The largest share of transactions occurred in Riga (17 out of 46 transactions), followed by the Pieriga region (15) and Jurmala (14). However, the highest total transaction value was recorded in Jurmala, followed by Riga and the Pieriga region. The biggest increase was observed in Jurmala, where sales volume more than doubled compared to 2023. Riga showed moderate results over the past three years, while the Pieriga region saw a 35% decline in total transaction volume in 2024 (Figure 13).

By compiling the Latvian premium housing market overview and data for 2024, Latvia Sotheby’s International Realty’s research aimed to analyse premium real estate market trends in Riga, Jurmala and the Baltic region, focusing on three main segments – apartments, private houses and land. The results show that, despite reduced inflation and stabilised interest rates, the market is still characterised by selective activity, which varies according to property type, location and price category.

In the apartment segment, the highest activity is observed in Riga and the Baltic Sea Region, especially in the price category up to EUR 300 000. In Riga, demand in this segment reached a five-year high, while in the Baltic Sea region this segment accounts for more than 90% of all apartment transactions. In Jurmala, the situation has improved, but overall activity is still below 2021-2022 levels.

In the private residential segment, the Baltic Sea region leads with the highest transaction volumes and stable average prices, while Riga experienced a significant decline. The Jurmala house market remained selective, with overall volumes declining and average prices rising, with a high number of transactions especially in the most exclusive properties above EUR 1 million.

The land market in 2024 shows moderate activity. The highest transaction volume was recorded in Jurmala, where turnover doubled compared to the previous year. In Riga and the Baltic Sea Region the market remained stable or experienced a slight decline.

Overall, Latvia Sotheby’s International Realty is pleased to note that the premium real estate market in Latvia in 2024 has demonstrated high resilience and gradual growth in certain segments.