Latvia Sotheby’s International Realty’s sales team observations and completed transactions in 2025 confirm the continued growth of Latvia’s premium residential market, reflecting buyer sophistication and the enduring role of high-end properties as a safe and strategic asset.

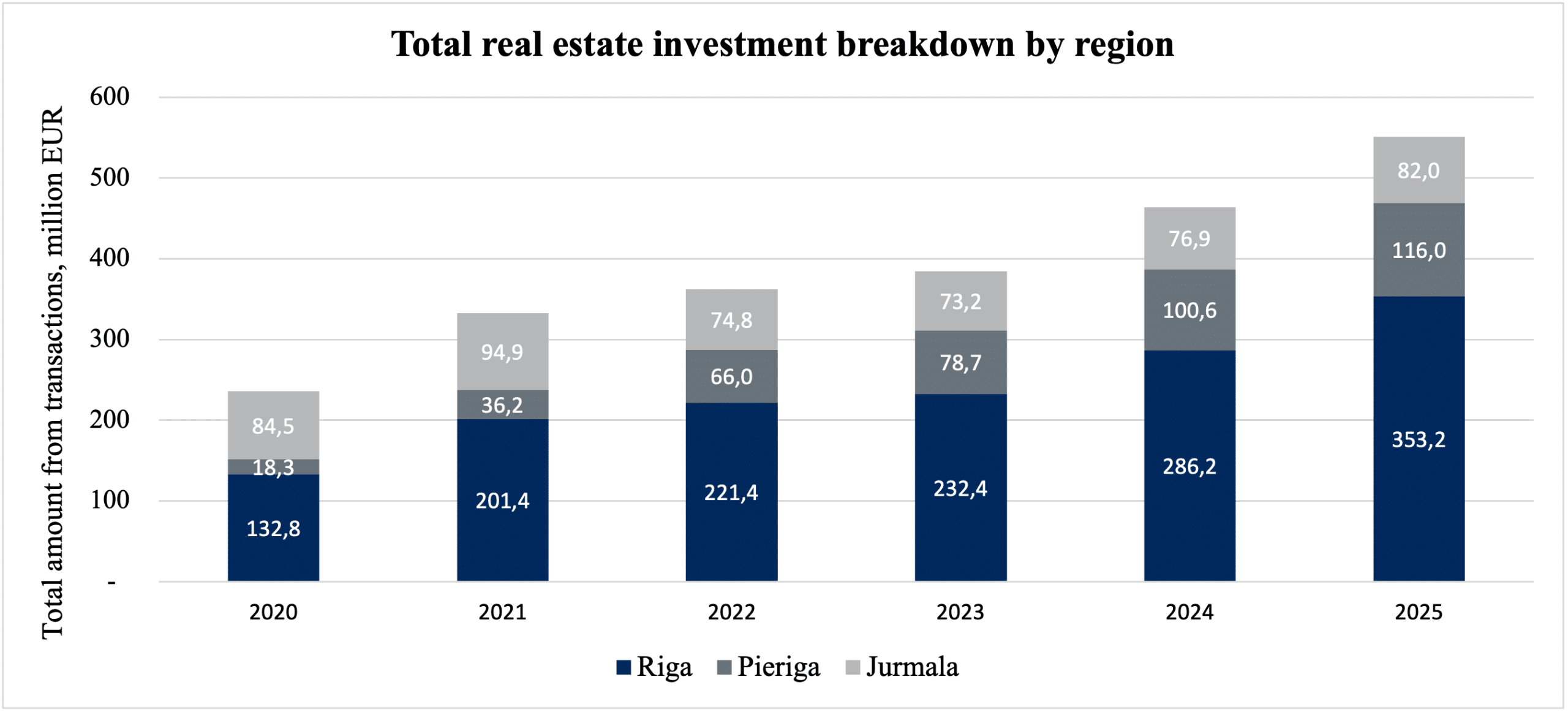

A review of the 2025 market data demonstrates that the premium residential segment has proven its resilience and maturity. According to company-collected data from Riga, the Riga region, and Jurmala, total premium segment transaction volume exceeded €550 million, showing growth across all key categories.

Major 2025 Transactions by Latvia Sotheby’s International Realty

For Latvia Sotheby’s International Realty, 2025 was a strategically significant year of growth and consolidation. The company once again reaffirmed its leadership in Latvia’s premium real estate market, completing transactions totaling €70 million. A total of 337 deals were successfully closed, including 206 sales and 131 rental transactions, highlighting the company’s balanced presence across both market segments and the high level of long-term client trust.

The scale and structure of these transactions clearly reflect the team’s expertise in handling high-value, complex, and strategically significant properties across a wide range of segments – from commercial land and buildings to exclusive villas, luxury apartments, and international deals outside Latvia. The largest transactions of 2025 were concentrated in Riga and Jurmala, further underscoring the company’s international reach and access to the global Sotheby’s International Realty network.

Notable Transactions in 2025

Commercial Land:

Commercial Properties:

Houses:

Apartments:

International Transactions:

These transactions not only illustrate the market activity in 2025 but also highlight the trust clients place in Latvia Sotheby’s International Realty as a partner capable of delivering professional representation at the highest level, both locally and internationally. They provide a clear foundation for in-depth market analysis, client profiling, and understanding the trends that shaped the premium segment throughout 2025.

Latvia Sotheby’s International Realty – Client Profile in 2025

In 2025, the client structure of Latvia Sotheby’s International Realty reflected the maturity, financial stability, and long-term value perspective characteristic of the premium real estate market.

The seller and landlord segment showed a balanced distribution between individuals (54%) and legal entities (46%). This group demonstrated a high level of life-cycle and investment maturity: 60% of clients were aged 40 – 59, and a strong majority (79%) represented local Latvian capital. When selecting a service provider, trust, reputation, and personal experience were decisive – 85% of relationships were initiated through direct recommendations. This confirms that in the premium segment, decisions are largely based on long-standing relationships and proven professionalism.

The buyer and tenant segment displayed a younger and more dynamic profile. Individuals dominated this group, accounting for 90% of transactions, while legal entities represented 10%. The majority of clients were aged 30 – 49 (64%) and financially independent, with 77% of transactions completed using personal funds rather than bank financing. While local clients remained the majority, foreign buyers and tenants accounted for 28%, highlighting the growing international appeal of Latvia’s premium residential market.

When selecting information channels, buyers demonstrated a noticeably stronger digital orientation. While recommendations continued to play an important role (37.3%), real estate portals were also widely used – particularly SS.COM (36%) and City24.lv (13.5%). This combination highlights the modern premium buyer’s ability to integrate personal recommendations with data-driven, independent market research.

Overall, the 2025 client profiles demonstrate that Latvia Sotheby’s International Realty served discerning, experienced, and financially strong clients who value not only property quality but also professional guidance, reputation, and long-term collaboration.

Latvia’s Premium Residential Market – 2025 Overview

Latvia Sotheby’s International Realty conducted an in-depth analysis of the premium residential market across Riga, Jurmala, and the Riga region, focusing on three primary segments: land, apartments, and villas. In the Riga region, the study included transactions from the municipalities of Ādaži, Ķekava, Mārupes, Olaine, Ropaži, Salaspils, Saulkrasti, and Sigulda. The analysis was based on publicly available transaction data from the Land Register, collected up to January 12, 2026.

The study included only transactions that met specific property type and price criteria characteristic of the premium segment. Land transactions were analyzed for villa development, with a minimum transaction value of €150,000. The apartment segment encompassed both standard apartments and row/duplex houses with a minimum purchase price of €150,000. Villas were assessed based on the main building area and a minimum transaction value of €350,000.

All data were carefully adjusted based on Latvia Sotheby’s International Realty’s internal insights into the actual nature of each transaction, ensuring analytical accuracy and a true reflection of the market.

Overall Market Review by Latvia Sotheby’s International Realty

In 2025, Latvia’s premium residential real estate market demonstrated stable and balanced activity. Across Riga, the Riga region, and Jurmala, total transaction volume in the premium segment exceeded €550 million. Apartments consistently reinforced their role as the most liquid premium asset, serving both as an accessible housing option and a strong investment opportunity.

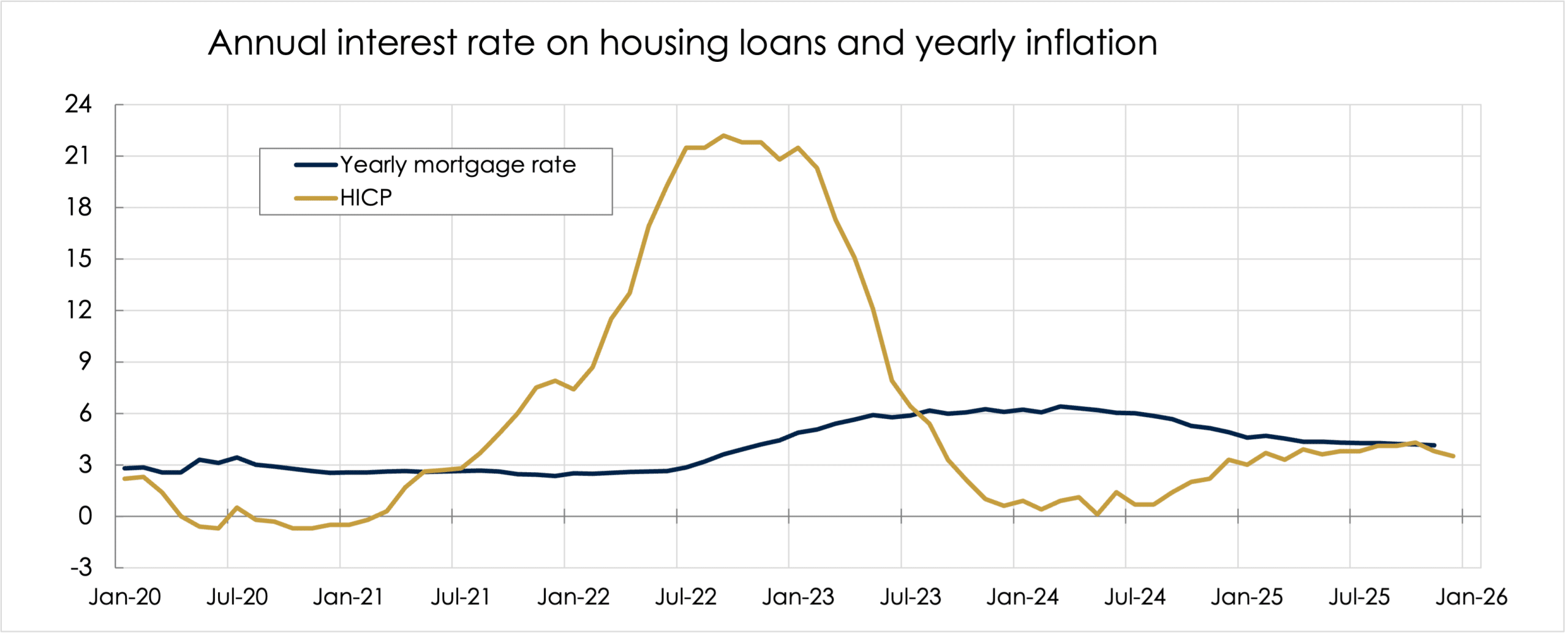

In 2025, the macroeconomic environment became more favorable for buyer decision-making. Inflation stabilized within the 3–4% range, while annual mortgage interest rates gradually declined, ending the year slightly above 4%. Although financing costs remained relatively high, the downward trend in interest rates significantly improved buyer sentiment and facilitated the completion of previously postponed transactions.

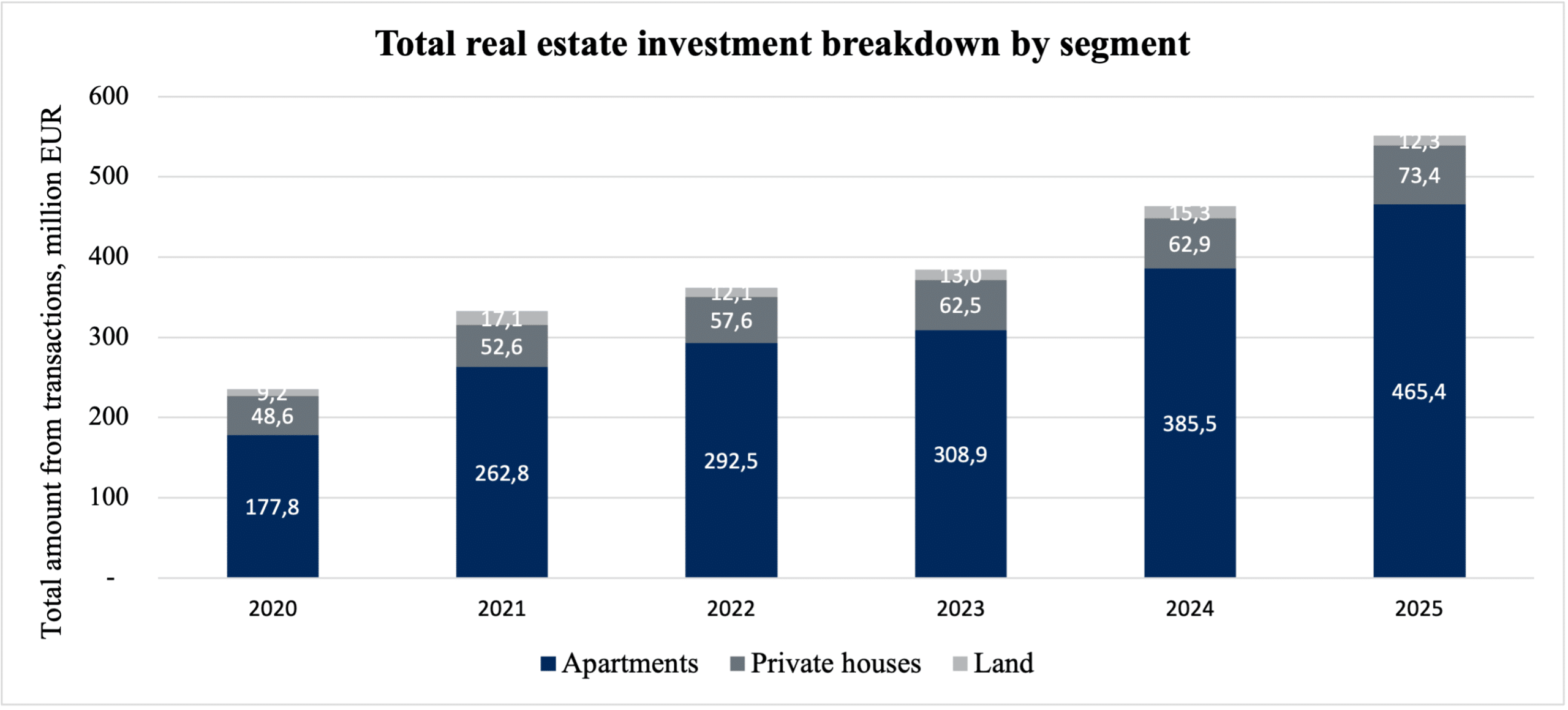

According to Latvia Sotheby’s International Realty, the 2025 market structure clearly reflected buyer priorities in the premium segment. Apartment transactions reached €465.4 million, representing the dominant share of the market, while the villa segment provided a stable, though comparatively smaller, contribution of €73.4 million. The land segment remained cautious, with total transaction volume of €12.3 million, reflecting buyers’ selective approach and focus on ready-to-use properties.

Throughout 2025, the market continued to develop along previously established trends, with transaction volumes increasing while buyer and seller behavior remained rational and value-oriented.

Apartment Segment

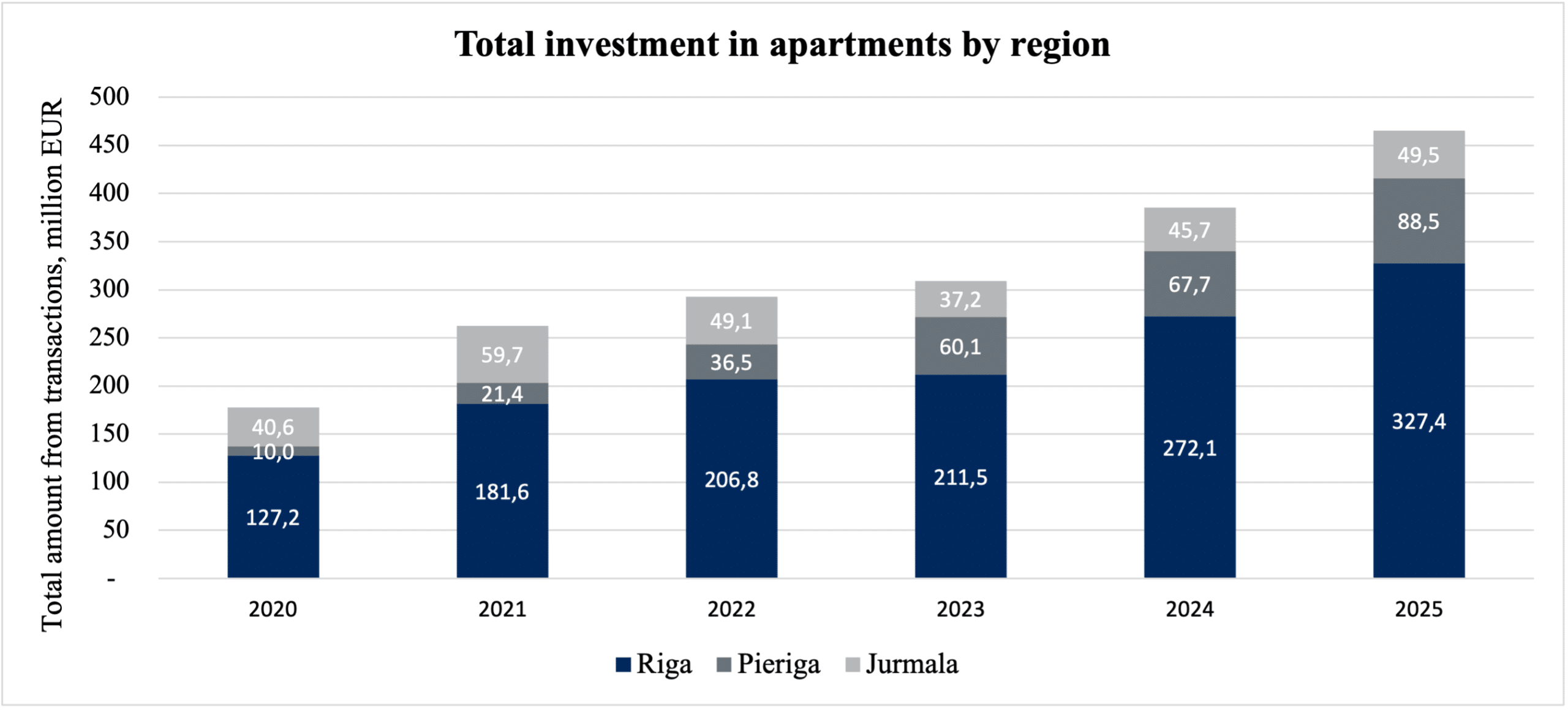

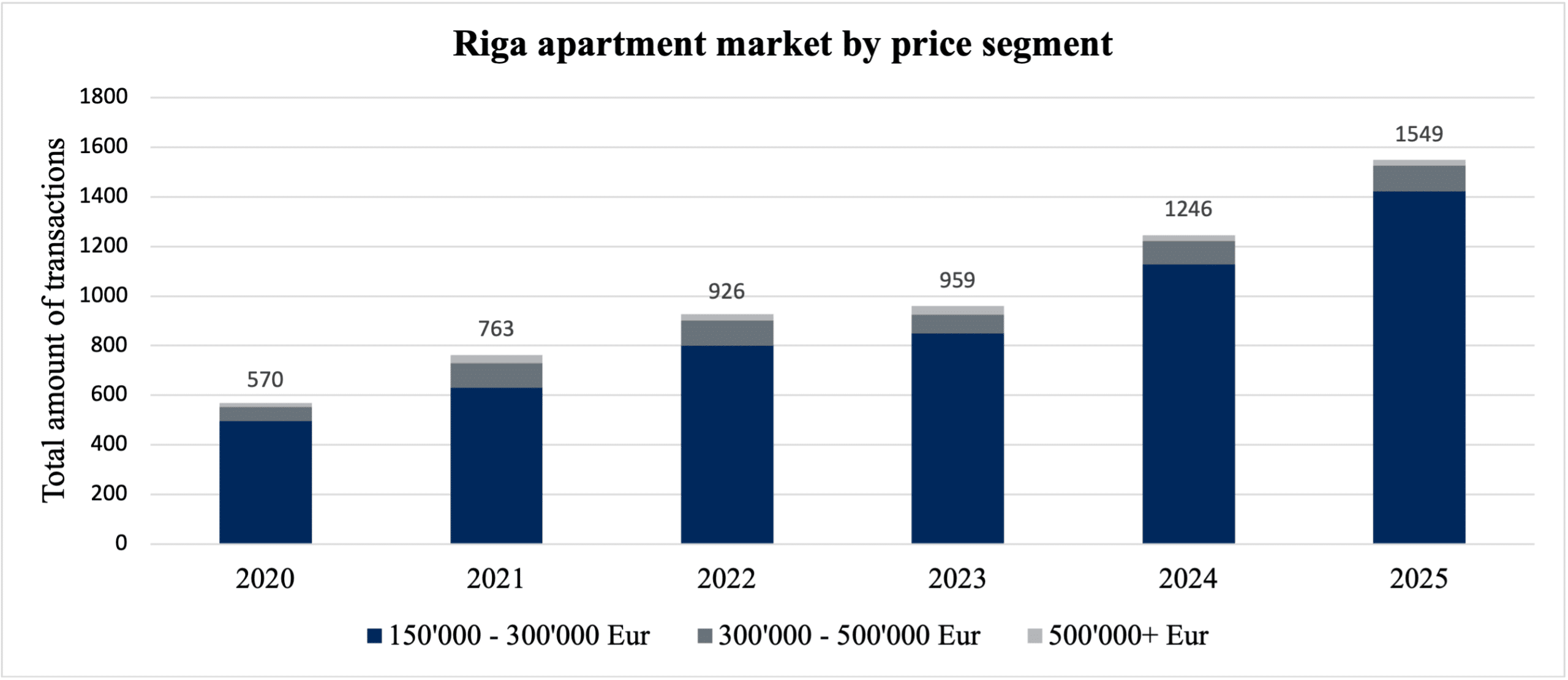

In 2025, a total of 2,163 apartment transactions were completed across Riga, the Riga region, and Jurmala, reaching a total volume of €465.4 million—a 21% increase compared to 2024. Compared with the previous year, both the number of transactions (+25%) and the total square meters sold (+17%) grew, although demand and purchasing power for smaller properties remained unevenly distributed.

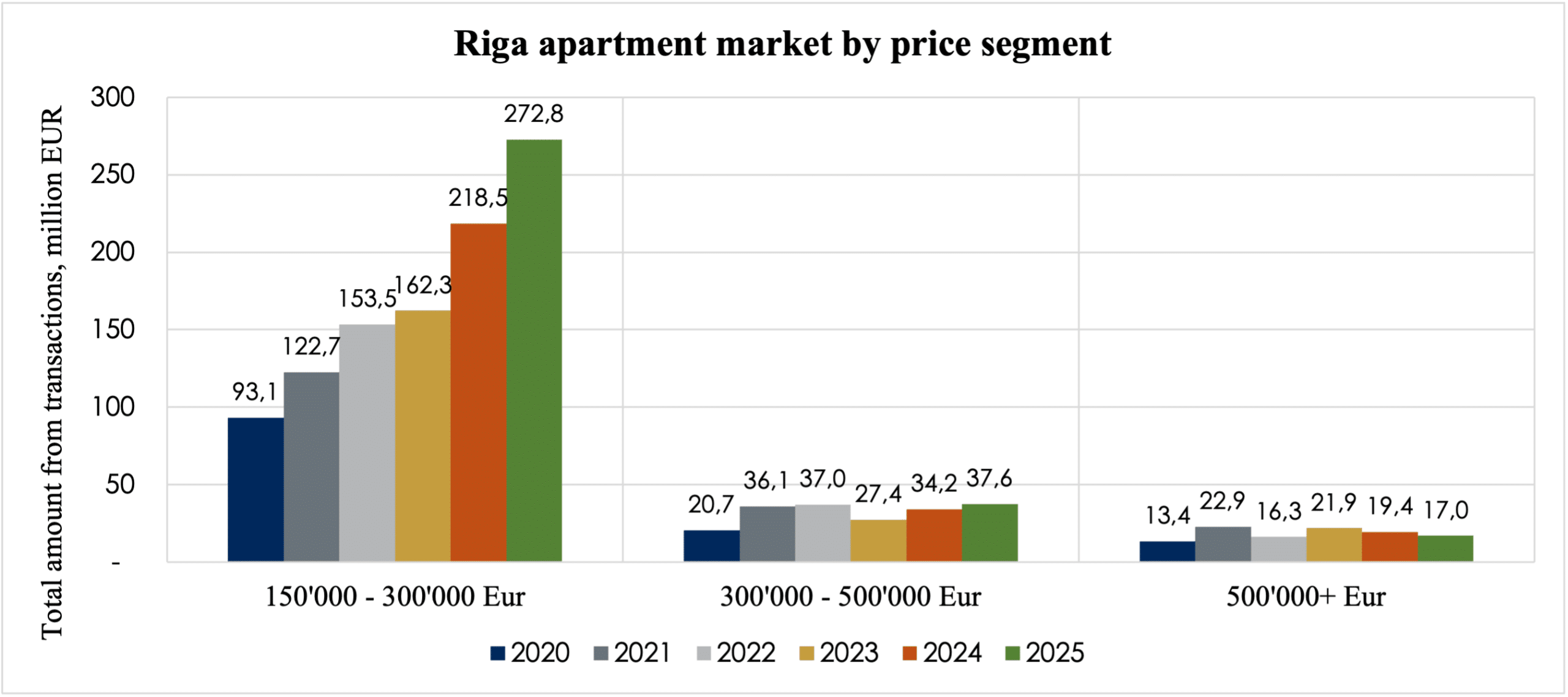

In 2025, Riga maintained its dominant position in the premium apartment market. A total of 1,549 transactions were completed in the capital, totaling €327.4 million – over two-thirds of the entire premium apartment market volume.

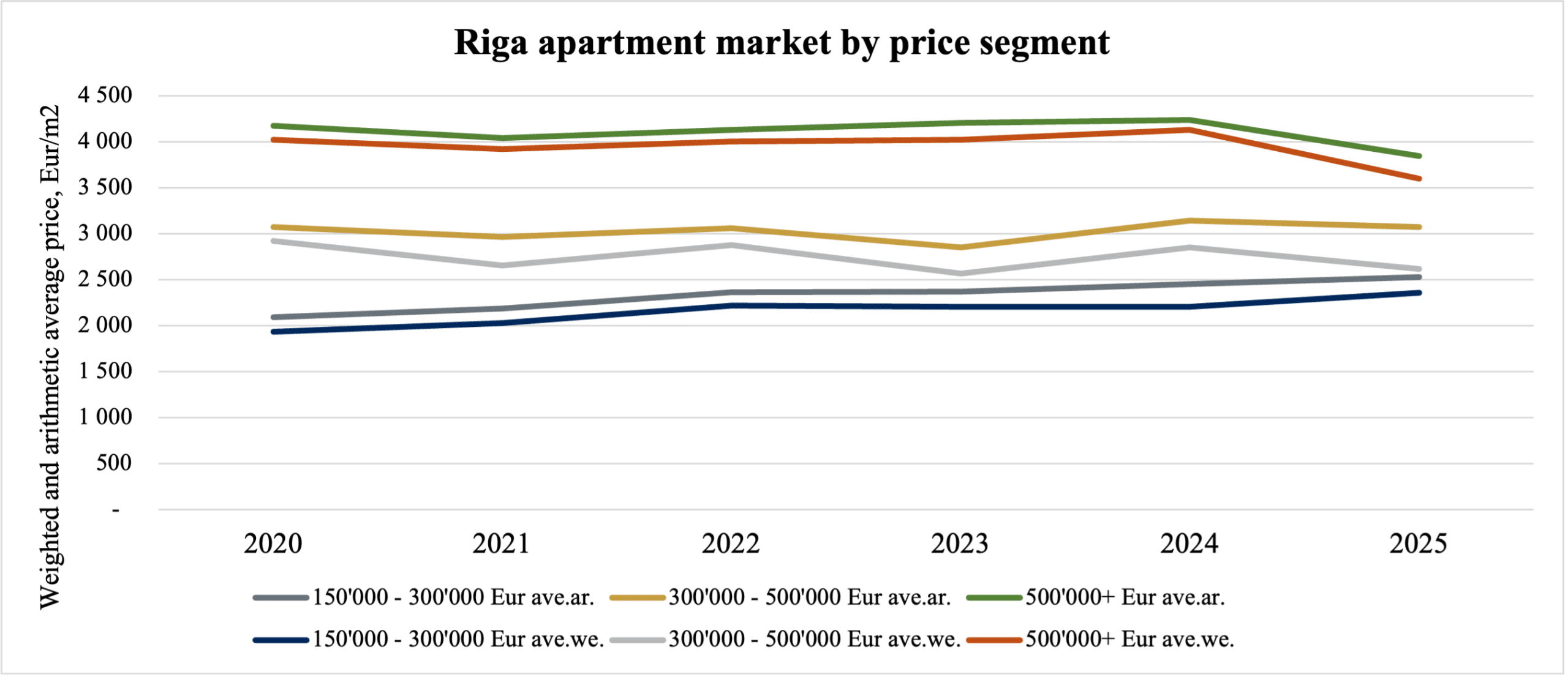

Market activity remained concentrated in the €150,000-€300,000 price segment, which recorded the highest transaction volume during the period analyzed. Demand in higher price segments also remained stable, although the number of transactions for properties above €500,000 was significantly smaller. This indicates that the pool of buyers able to purchase and choose properties over €300,000 remains relatively consistent, while rising prices in new developments are increasingly pushing buyers to spend over €150,000 for a new apartment.The weighted average price per square meter for all premium apartments in Riga reached €2,424 in 2025, remaining relatively consistent with previous years.

Riga Region.

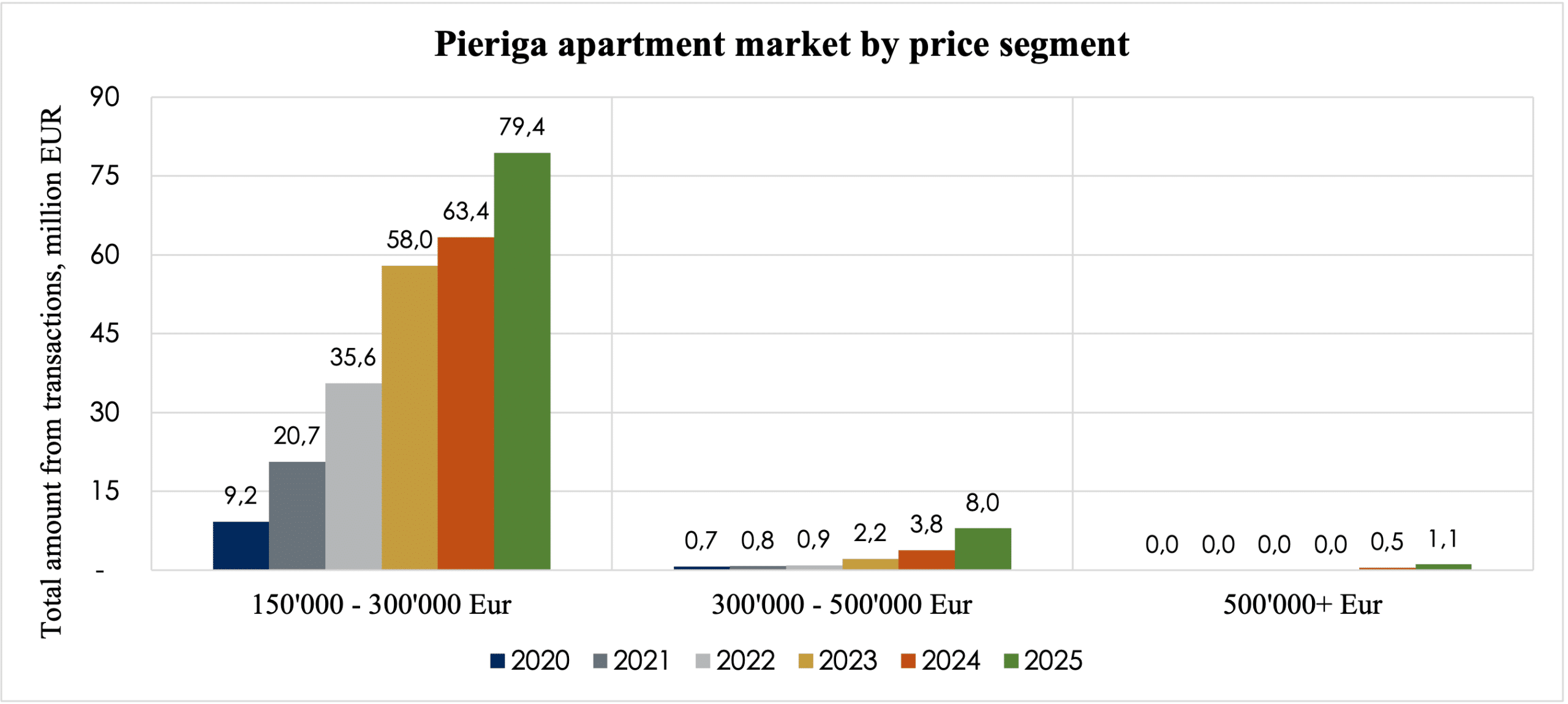

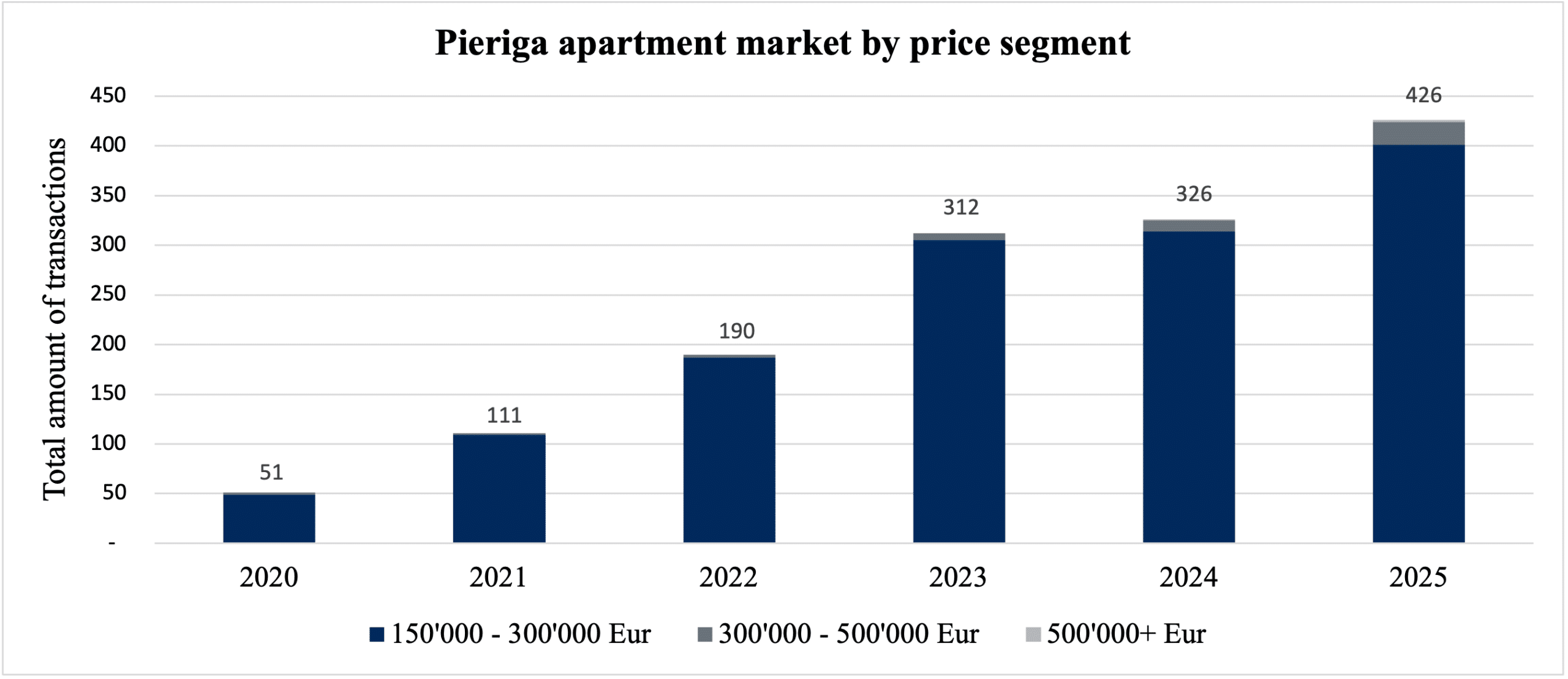

In 2025, the premium apartment market in the Riga region recorded the fastest relative growth, increasing by approximately 30% compared to the previous year. A total of 426 transactions were completed, with a combined volume of €88.5 million, significantly surpassing the prior year’s activity.

A notable portion of transactions involved row houses, reflecting strong buyer interest in functional, family-oriented homes outside the capital. While higher-priced segments still represent a relatively small share of the market in Pierīga, activity in these segments grew in 2025, signaling a gradual emergence of premium offerings beyond Riga.

The weighted average price per square meter in Pierīga reached €1,853, clearly indicating a more accessible price point compared to central Riga and offering the opportunity to acquire larger properties.

Jurmala.

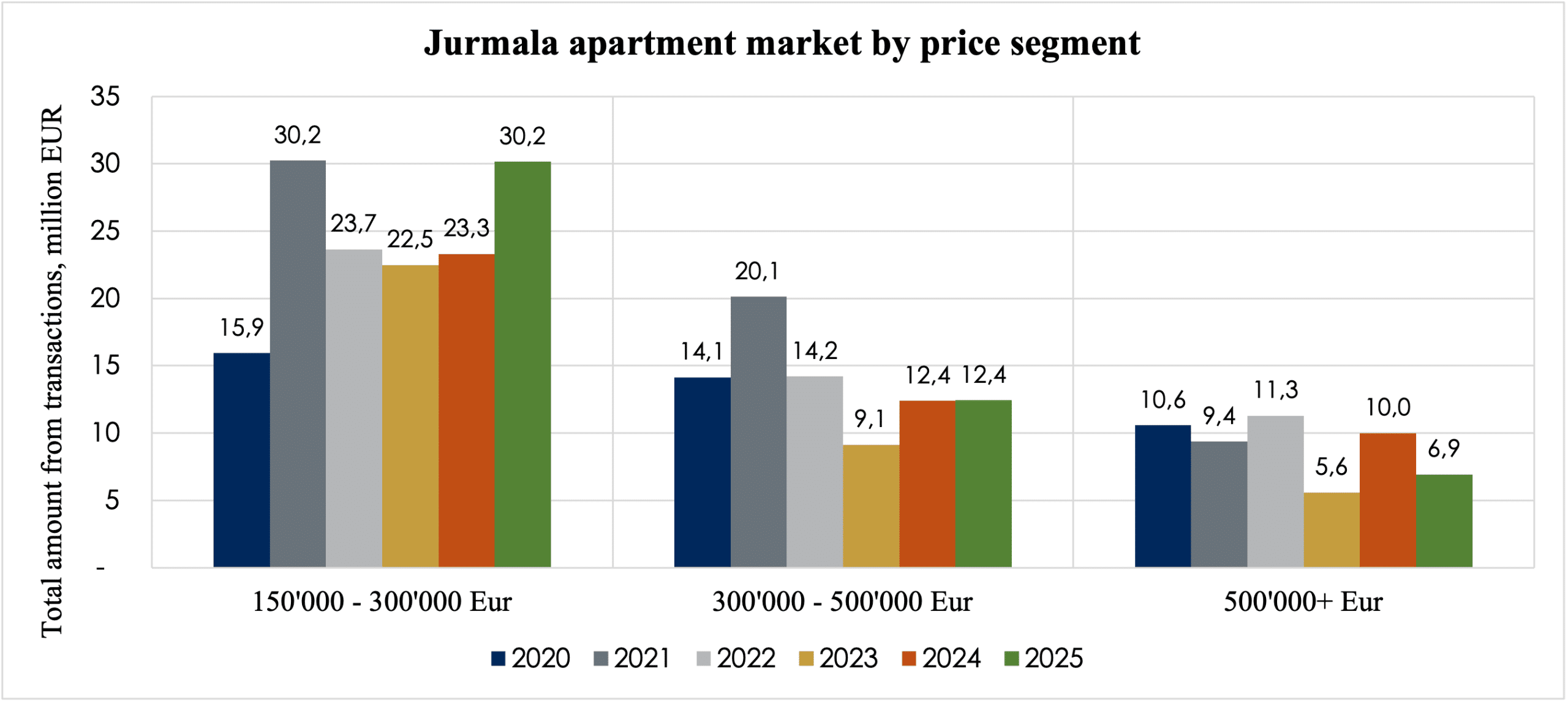

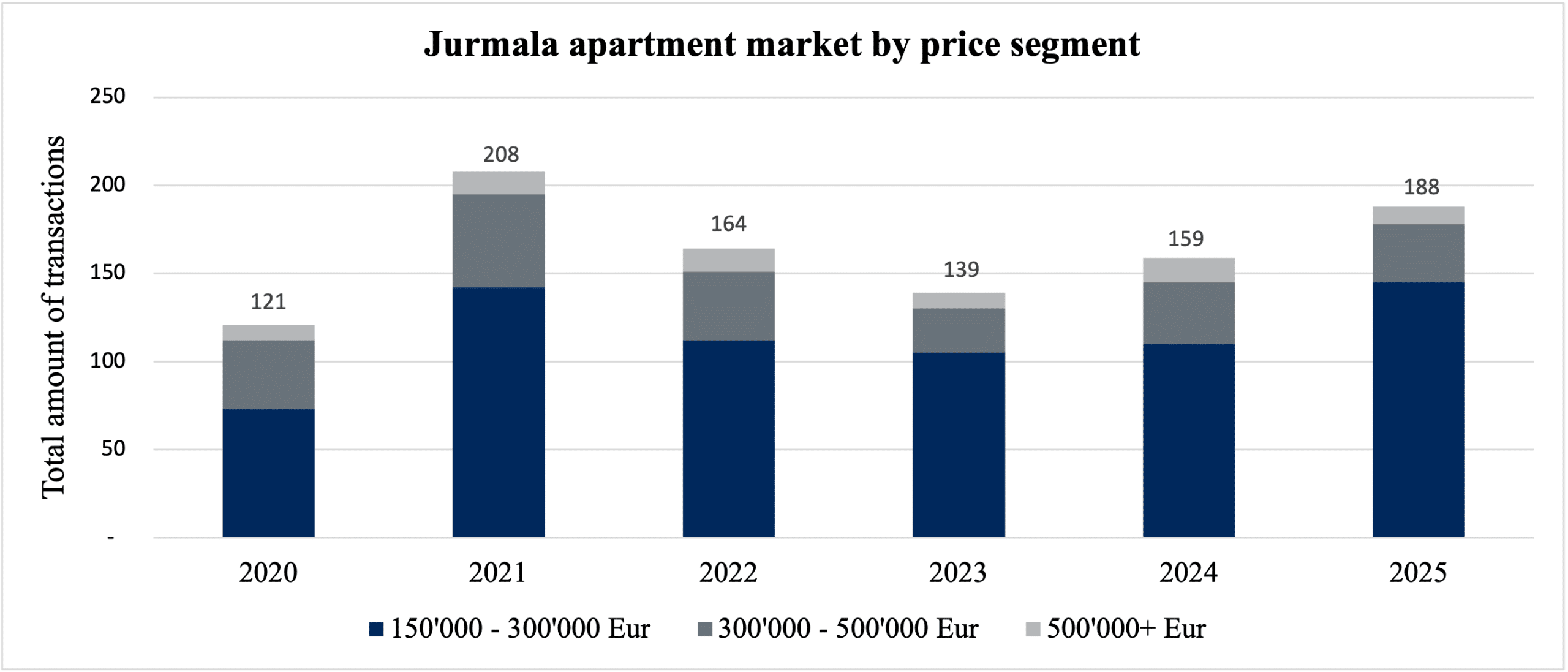

In 2025, Jurmala continued to assert its unique position in the premium apartment market as a niche yet high-value segment. A total of 188 transactions were completed (+18% compared to 2024), with a combined volume of €49.5 million (+8% compared to 2024).

Unlike Riga and the Riga region, a significant portion of Jurmala’s market was concentrated in the higher-priced segment above €300,000, reflecting buyers’ strong focus on exclusivity, seaside location, and the limited availability of high-value properties.

In 2025, Riga’s apartment market solidified its position as a relatively high-priced option for active city living in central and highly sought-after neighborhoods. In the Riga region, family-oriented homes with larger living spaces and a calmer environment dominated, while in Jurmala, the apartment segment retained its niche character, catering to high-end and luxury buyers.

Overall, apartments remained the most in-demand and stable segment within Latvia’s premium residential market, providing a solid foundation for continued market development in the years ahead.

Private House Segment.

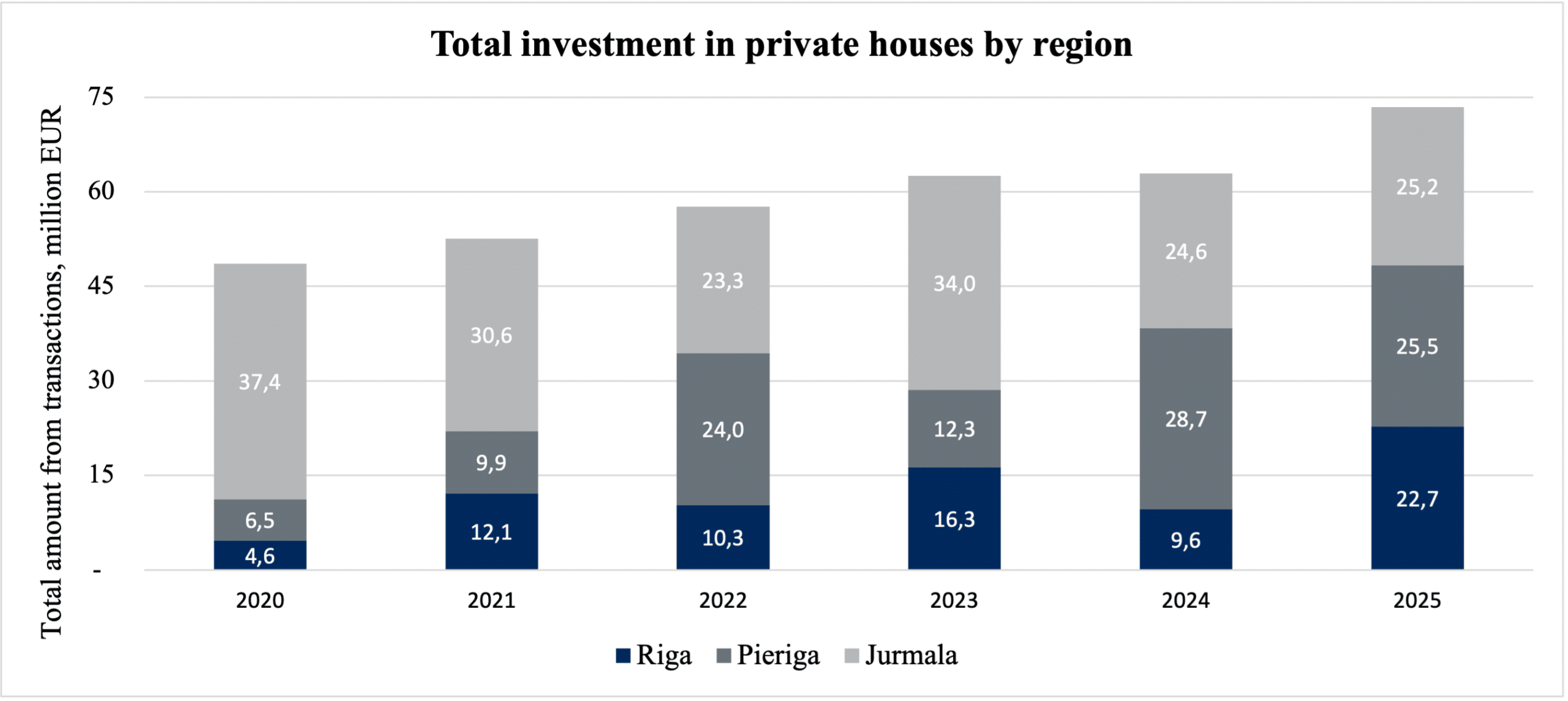

In 2025, the premium villa segment maintained a stable yet selective role within Latvia’s luxury real estate market. Across Riga, the Riga region, and Jurmala, a total of 113 villa transactions were completed, amounting to €73.4 million in total transaction volume.

The market share was relatively evenly distributed among the three regions. While the highest number of transactions occurred in the Riga region (53), compared to 31 in Riga and 29 in Jurmala, the total transaction volumes were closely aligned. Pierīga led slightly with €25.5 million, followed by Jurmala at €25.1 million, and Riga at €22.7 million.

Riga.

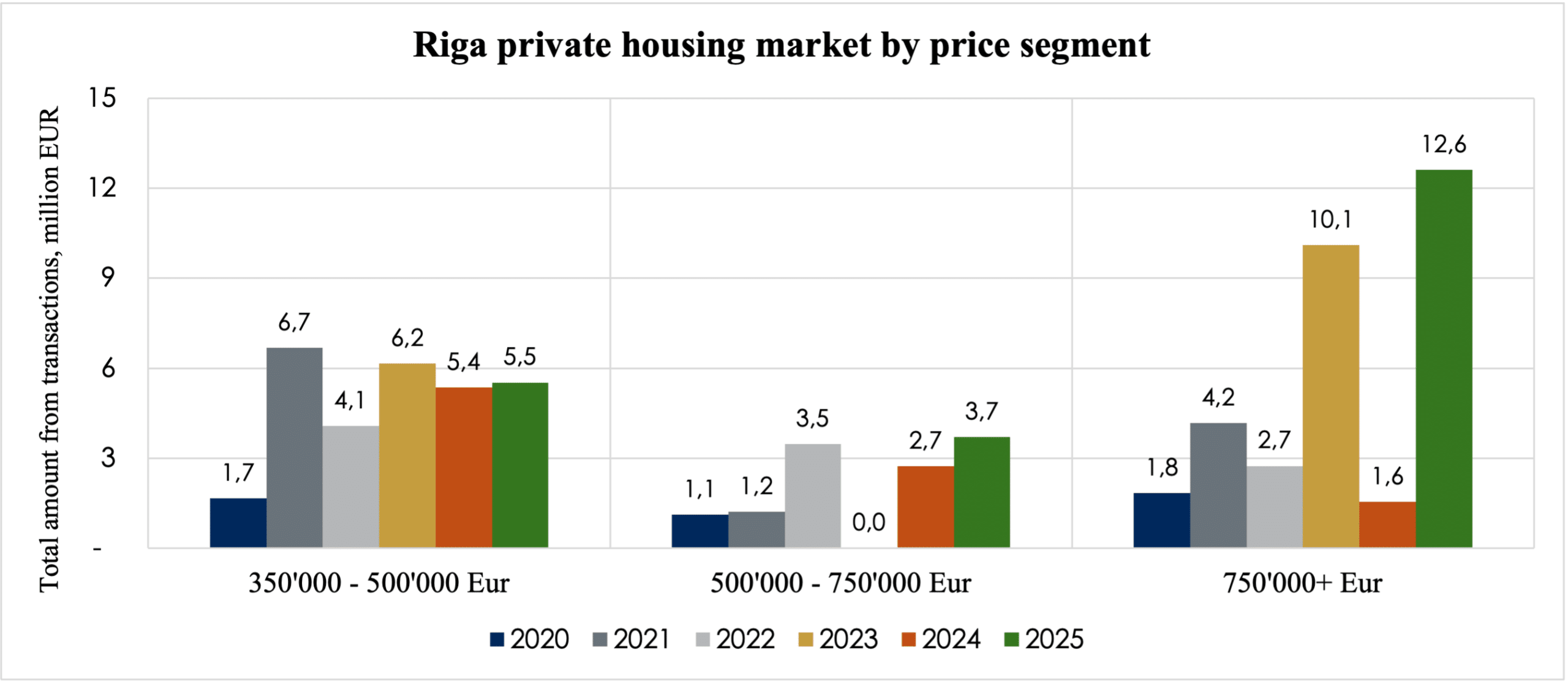

In 2025, Riga’s premium villa market showed strong transaction activity and a high average deal value. A total of 31 villa transactions were completed in the capital, totaling €22.7 million.

Most transactions were concentrated in the €350,000 to €500,000 price range, while individual deals above €750,000 contributed the most to the overall volume, reaching the highest level across the analyzed period. Notably, nearly half of this total volume was generated by just two villa transactions on Mazā Nometņu Street.

Riga Region.

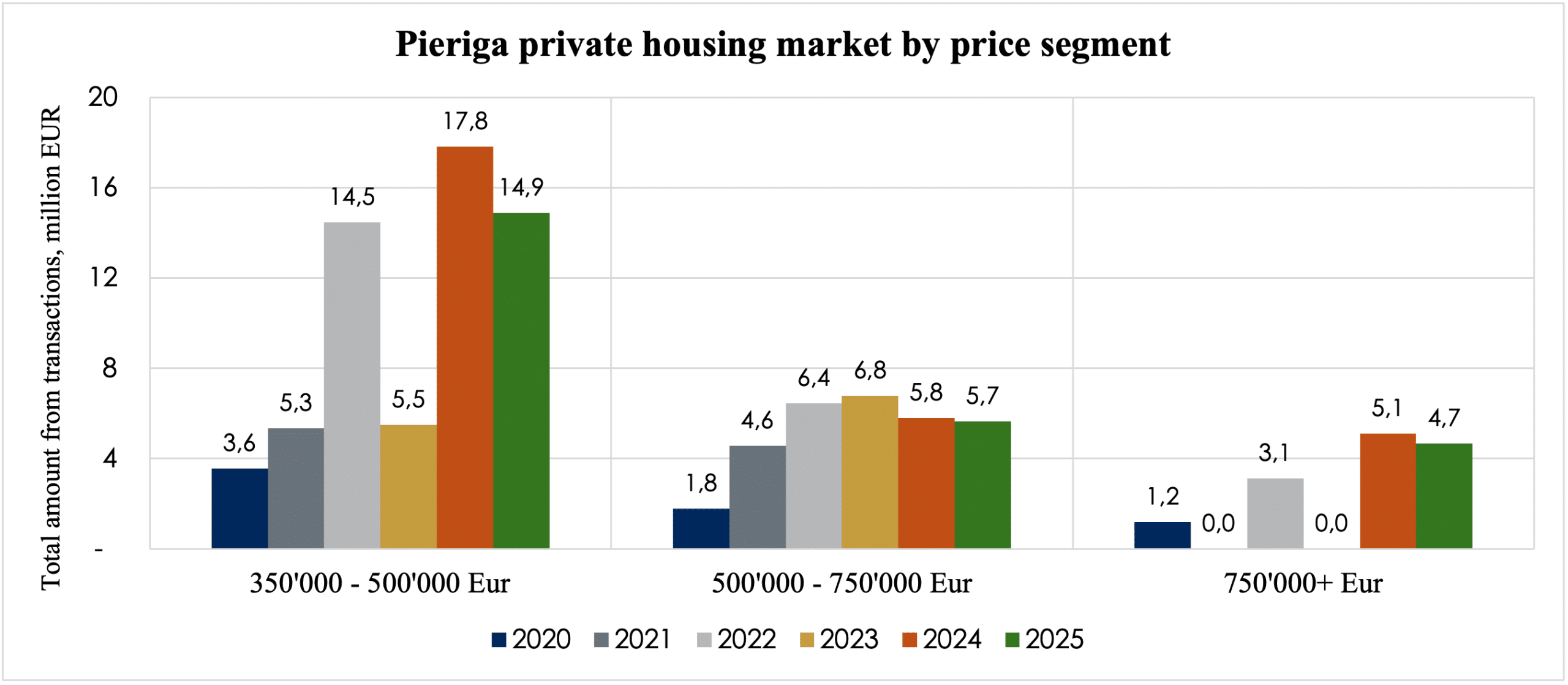

In 2025, the Pierīga premium villa market continued to expand, maintaining its position as the most active segment by transaction count. A total of 53 villa deals were completed in the region, totaling €25.5 million.

Unlike Riga, transactions in Pierīga were more evenly distributed across price segments, particularly in the €350,000–€500,000 and €500,000–€750,000 ranges.

Latvia Sotheby’s International Realty notes that this structure reflects buyers’ desire for larger living spaces, private plots, and greater privacy, while still benefiting from a comparatively more accessible price point than the capital. At the same time, high-end villas above €750,000 solidified their presence in Pierīga, underscoring growing interest in a premium lifestyle outside Riga.

Jurmala

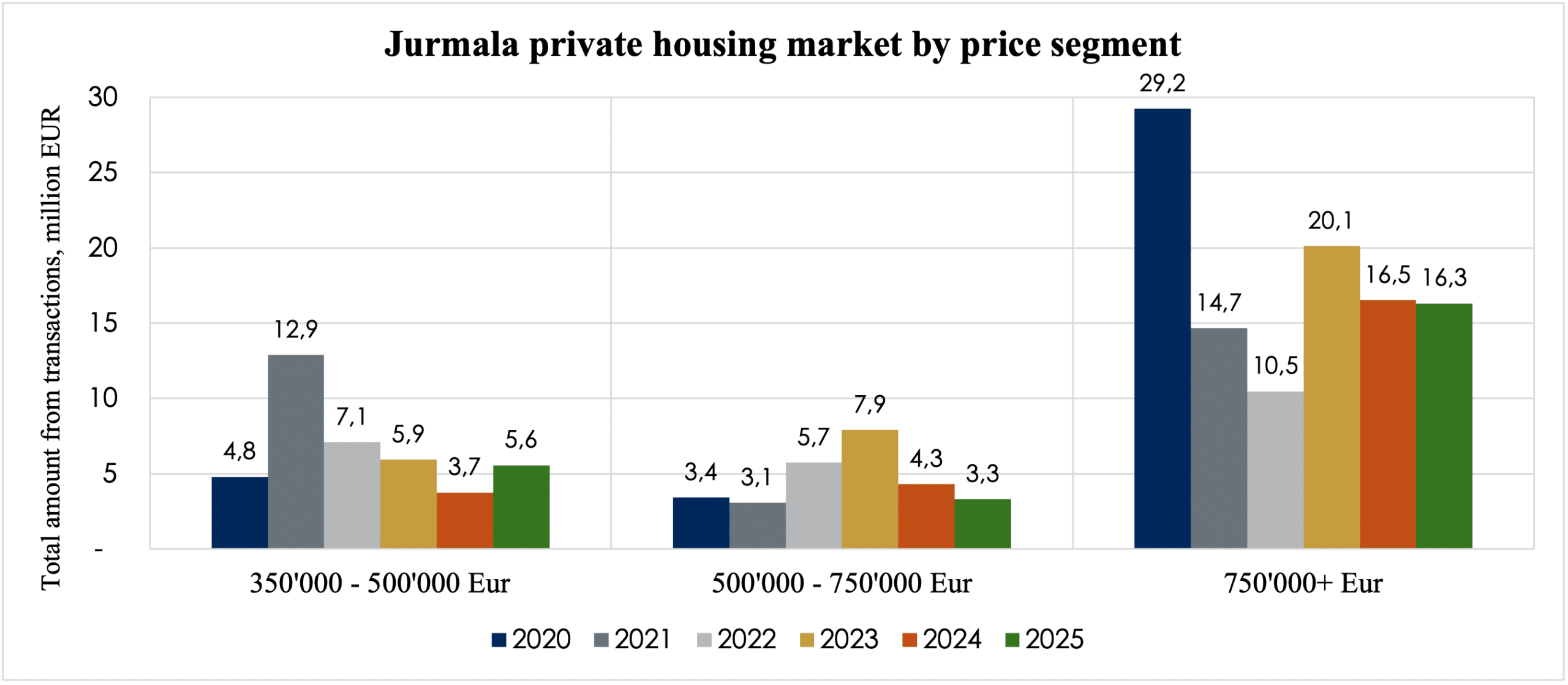

In 2025, Jūrmala’s premium villa market stood out with the highest average transaction values and a clear focus on exclusive properties. A total of 29 villa transactions were completed in the region, totaling €25.2 million, with a significant portion concentrated in the €750,000+ price segment.

Latvia Sotheby’s International Realty notes that Jūrmala retains its unique position as a resort city with limited supply, where villas are often regarded not only as homes but also as long-term capital investments. The structure of transactions highlights that buyers in Jūrmala are willing to pay a premium for location, land quality, and privacy, while maintaining high standards for the property’s technical condition, architectural design, and historical significance.

Land Segment.

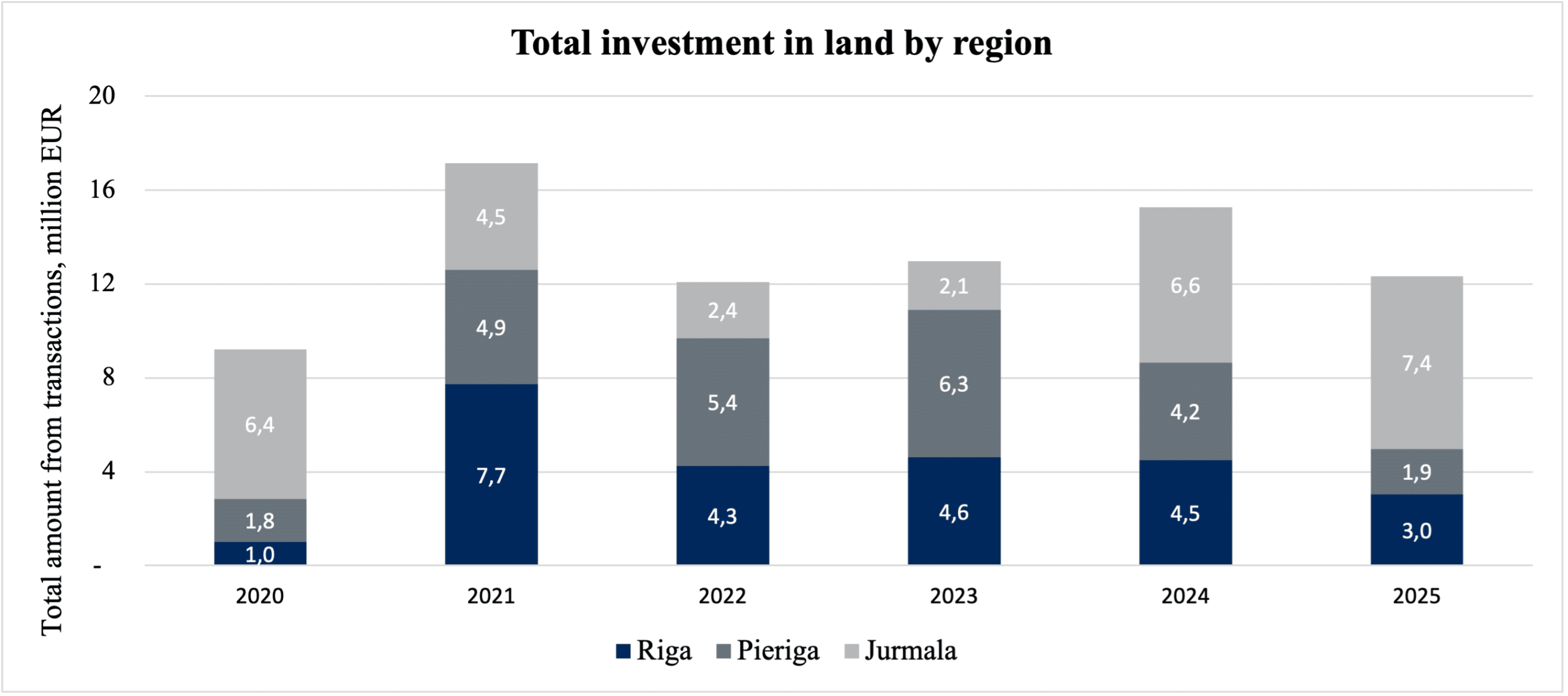

The allocation of investments across regions in the land segment is highly uneven and fluctuating, as total volumes are strongly influenced by a small number of high-value transactions, which can shift the leading region from year to year. In 2025, the land segment in Rīga, Pierīga, and Jūrmala was characterized by moderate activity and a highly selective buyer approach.

A total of 34 transactions were completed, amounting to €12.3 million, with Jūrmala dominating by accounting for more than half of the total transaction value.

In Rīga and Pierīga, both the number of transactions and the total volume remained limited, reflecting not only a scarcity of available plots but also buyers’ high standards regarding land development potential

Conclusion

The Latvian premium residential real estate market in 2025 has once again demonstrated its resilience, structural sophistication, and the discerning, value-driven approach of its clientele. Despite the persistence of relatively elevated financing costs, market activity expanded across all key segments, with the apartment sector retaining its position as the most liquid and sought-after asset class. In the single-family home and land segments, transactions were marked by selectivity and elevated value, driven by enduring quality, prime locations, and long-term investment potential rather than speculative motives.

From a regional perspective, Riga reaffirmed its status as the principal hub by transaction volume, Pieriga distinguished itself through the most pronounced relative growth and an increasingly diverse offering tailored to family living, while Jūrmala continued to embody an exclusive enclave, characterized by high-value transactions and a deliberately limited supply, epitomizing the very essence of premium coastal living.

“The year 2025 in Latvia’s premium residential market was marked by consistent growth along an already well-established trajectory, with transaction volumes and market activity increasing steadily, yet without significant structural changes. The market continued its gradual and predictable expansion, supported by a stabilized macroeconomic environment and buyers’ ability to adapt to prevailing price levels. This dynamic underscores that the premium segment in 2025 matured into a sustainable market with enduring demand, rather than a cyclical or volatile environment.

I am proud of our team’s dedication and achievements in 2025. It is the professionalism, cohesion, and trust of our partners that have made these results possible. My sincere thanks to all colleagues for their daily commitment and exceptional effort.”

– Ilze Mazurenko, Owner, Latvia Sotheby’s International Realty & Real Estate Market Expert

Engage with our premium Real Estate specialists – schedule your consultation today!

[email protected]

+371 29 171 747